|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

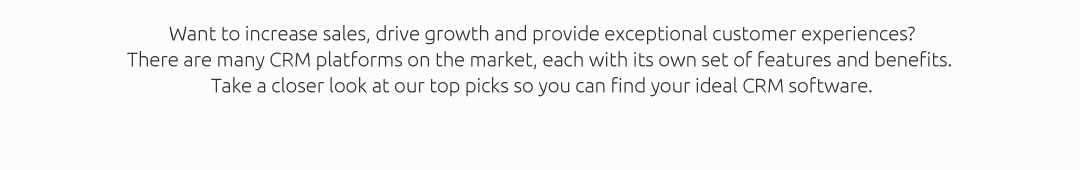

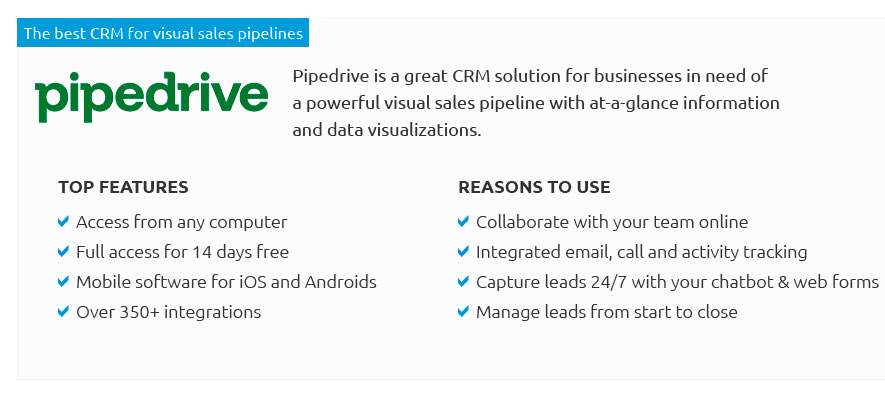

Understanding Insurance Agency CRM Software: Common Mistakes to AvoidIn today's rapidly evolving digital landscape, insurance agencies are increasingly turning to Customer Relationship Management (CRM) software to streamline operations, enhance customer engagement, and ultimately drive growth. However, implementing a CRM system is not without its challenges. As an insurance professional, understanding common pitfalls can be instrumental in ensuring a smooth and successful integration of this technology. Below, we delve into some of the frequent mistakes agencies make and how to avoid them. Choosing a CRM Without Customization Options: One of the critical errors agencies often make is selecting a CRM system that lacks flexibility. Every insurance agency operates differently, with unique processes and specific client needs. Opting for a CRM that cannot be tailored to your agency's particular requirements can lead to inefficiencies and frustration. Instead, seek out software solutions that offer robust customization capabilities, allowing you to modify features and workflows to align with your agency's operations. Overlooking Integration Capabilities: Another common oversight is neglecting to consider how well the CRM integrates with existing systems. An effective CRM should seamlessly connect with your agency's other software, such as policy management systems, accounting tools, and communication platforms. Failing to prioritize integration can result in data silos, redundant data entry, and a fragmented view of customer interactions. Ensure that any CRM solution you consider offers extensive API support and has a proven track record of successful integrations. Inadequate Training and User Adoption: Introducing a new CRM system is only as effective as the people using it. Agencies frequently underestimate the importance of comprehensive training and change management. Without proper training, staff may resist adopting the new system, leading to underutilization and wasted investment. To counter this, invest in thorough training programs and provide continuous support to encourage user adoption and proficiency. Neglecting Data Quality and Management: The adage 'garbage in, garbage out' rings particularly true when it comes to CRM systems. Poor data quality can severely undermine the effectiveness of CRM software. Agencies often fall into the trap of inputting inaccurate or incomplete data, resulting in unreliable insights and flawed customer interactions. Establishing robust data management protocols and regular data audits is essential to maintain data integrity and maximize the CRM's potential. Ignoring Customer-Centric Features: While it might be tempting to focus solely on operational efficiencies, ignoring customer-centric features can be detrimental. A CRM system should enhance your agency's ability to deliver exceptional customer experiences. Features such as personalized communication, automated follow-ups, and comprehensive customer profiles are crucial for nurturing client relationships. Evaluate CRM options with a keen eye on how they can enhance customer engagement and satisfaction.

https://monday.com/blog/crm-and-sales/crm-software-for-insurance-agents/

A CRM for insurance agents manages clients, quotes, policies, and other data in one centralized location. https://nextagency.com/

Your solution for insurance agency management. Saving life and health agencies time, money and clients with CRM, marketing and commission tools. https://www.vtiger.com/insurance-crm/

Vtiger gives you the flexibility to customize the CRM software for your insurance agency. Manage marketing campaigns, policy sales and renewals, customer ...

|